Greenwashing soars in 2023 within the European Financial Sector

Greenwashing soars in 2023 within the European Financial Sector

In 2023, a 72% increase in greenwashing incidents occurred within the financial services and banking sectors. And, ¼ of climate related ESG risk incidents were tied to greenwashing, up from the ⅕ in 2022.

According to RepRisk - an ESG data collector and provider - the number of greenwashing cases rose from 86 to 148 for the year ending September 2023. Of these, 106 cases were committed by European financial institutions. This has made the Financial Services Sector second only to the Oil and Gas sector concerning the number of greenwashing incidents. The European Banking Federation (EFB) responded that RepRisk’s findings are only allegations and are not verified claims of greenwashing. The EFB claims the proposed rise in greenwashing may result from increased scrutiny of banks and their sustainability commitments, rather than deliberate misrepresentation.

Whilst there is no legal definition of ‘greenwashing’, the term describes untrue or misleading statements about a business or company’s environmental performance. The goal is to boost financial performance: appearing more environmentally friendly, aligning with regulations and consumers to boost a company’s image and reputation, without implicitly reducing its environmental impact.

The three main forms of greenwashing

The most common form of greenwashing is misleading advertising. This takes the form of vague and general statements such as ‘’net zero” or “eco-friendly”, occurring in 37% of claims in 2021. The aim - to provide the impression the product has no negative effect on the environment.

October 2022 saw ASA ruling against HSBC over the claim “Climate change doesn’t do borders. Neither do rising sea levels. That’s why HSBC is aiming to provide up to $1 trillion in financing and investment globally to help our clients transition to net zero”. The reason is its omission of information concerning HSBC’s contribution to Carbon Dioxide and GHG emissions. These claims of ‘net zero’ are often a component of long-term ESG plans. They are unquantifiable, so should only be made if a clearly documented strategy exists. This means planning and adhering to short-term plans and commitments, which can be tracked and measured.

Firms can also misrepresent data to paint a more favourable picture. In June, The European Banking Authority highlighted the “clear increase” in risk of financial services misrepresenting their sustainability efforts. Banks and investors promote their support of clean energy initiatives despite also financing projects linked to non-renewable consumption, deforestation, and human rights abuses.

February 2023 saw the first climate-related lawsuit filed against a commercial bank. Several NGOs sued BNP Paribas as its activities breached French law - not harming the environment. This followed no change in its policies from the previous year. In January, the French banking group promised to cut 80% of funding supporting the extraction and production of Oil, and a 30% cut in the funding of Gas. As of May, it pledged to cease to finance new gas field projects. Described as a “step in the right direction” by Lorette Philippot, campaign lead at Friends of the Earth France, there is a long way to achieving the 2030 targets. Additionally, climate activists noted most of BNP’s support for fossil fuels is provided by corporate loans and bond underwriting services, outside the direct loans BNP addressed in the pledge.

Finally, deceit within Financial Services contributes to greenwashing. In 2021, an examination found that 59% of the dubious claims did not possess easily accessible evidence.Either purposefully or accidentally omitting information, or not adhering to laws and existing legislation has resulted in serious consequences. May 2023 saw BNY Mellon charged and fined $1.5 million for omitting information. Between January 2019 and March 2021, a BNY Mellon advised fund made 67 investments that lacked an ESG quality review score at the time of investment. These reportedly counted for close to 25 percent of the fund’s assets as of 31 March 2021.

A KPMG survey discovered two-thirds (67%) of adults would seek out sustainable products or services, and over half (54%) would stop buying from a company if they were found to have committed greenwashing. The focus must be on curbing greenwashing to help ‘improve consumer confidence and trust’ and enhance the market. The Paris Agreement, enforced from 4th November 2016, built on the 1994 United Nations Framework Convention on Climate Change. The Agreement’s goal was to strengthen the global response to climate change, requiring countries to set out their “Intended National Determined Contributions”. For financial institutions, Article 2.1(c) is particularly relevant – finance flows must be consistent with the sustainability objectives.

A paper by the European Central Bank found, following the agreement, banks reduced lending by 3% to more polluting firms, and a decrease of 2.38% to US polluting corporations after President Trump’s withdrawal from the agreement. This proved climate initiatives and policies can push banks towards greener business. It found smaller banks were the main drivers of this change. However, the language of the Paris Agreement is vague, so eight years on, there is still confusion as to how it should be implemented.

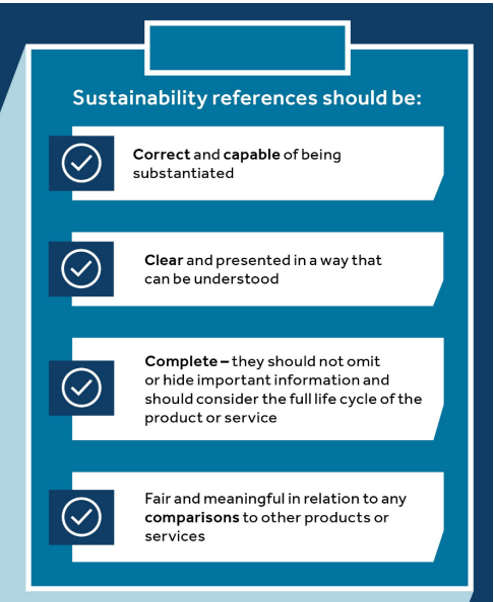

As of November 2023, the Financial Conduct Authority (FCA) set out guidance on the Anti-Greenwashing rule to give a stronger basis to challenge firms and enable enforcement action on the green credentials of their products. The current aim is to gather respondent’s views by 26 January 2024, before the guidance comes into effect on 31 May 2024. The FCA sets out guidance which must be considered whilst making sustainability claims (figure 1). Additionally, firms should regularly review their claims.

Figure 1 FCA GC23/3

The European Commission proposed the Green Claims Directive as of 22 March 2023 to be implemented in 2026. The Directive aims to address greenwashing to protect consumers, the environment and to aid businesses striving for sustainability. It seeks to ensure the legitimacy of environmental labels and claims, providing criteria for how companies should prove their proof before being checked by an accredited verifier. Sweeping and vague environmental claims such as “eco”, “net zero” and “climate neutral” will be banned unless detailed proof can be provided. Claims based on emissions offsetting will be similarly omitted.